JobMaker Hiring Credit

The first claim period for the JobMaker Hiring Credit has opened today, 1 February 2021, and closes on 30 April 2021.

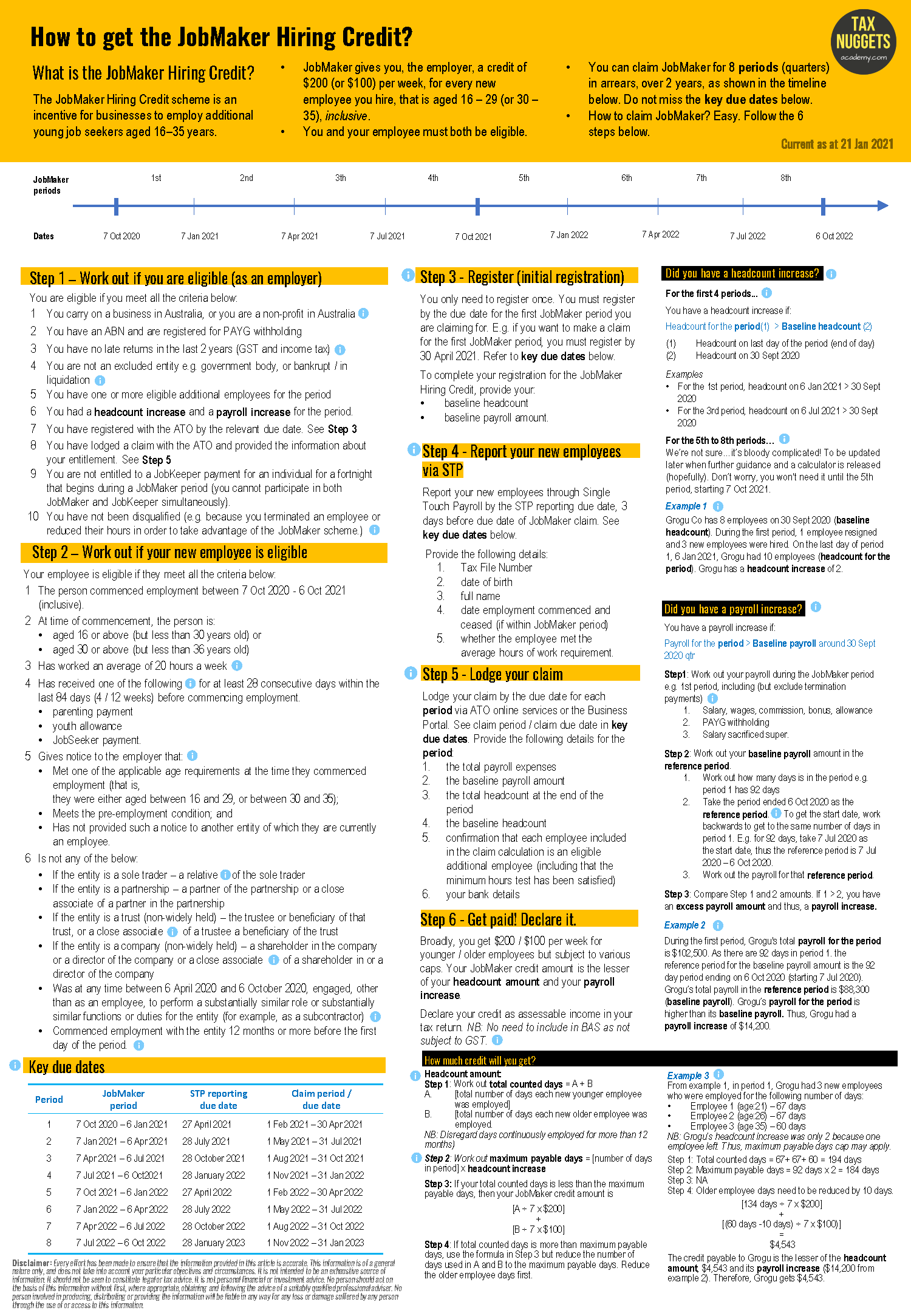

Under the hiring scheme, eligible businesses that create new eligible positions up to 6 October 2021 can claim payments to cover some of the new employee’s wages.

The Australian Taxation Office (ATO) has reminded businesses that in order to claim the credit they need to register as well as meet the eligibility requirements.

Businesses can register using ATO online services or the Business portal, or through a registered tax or BAS agent.

The ATO has published a JobMaker Hiring Credit guide for businesses and a tool for estimating claims.

Steps to follow to claim the JobMaker Hiring Credit

1. Work out if you are eligible (as an employer)

2. Work out if your new employee is eligible

3. Register (initial registration)

4. Report your new employees via STP

5. Lodge your claim

6. Get paid! Declare it.

JobMaker Cheat Sheet

Useful Links:

JobMaker Hiring Credit guide - https://www.ato.gov.au/general/JobMaker-Hiring-Credit/In-detail/JobMaker-Hiring-Credit-guide/

Claiming the JobMaker Hiring Credit - https://www.ato.gov.au/Business/Business-bulletins-newsroom/Employer-information/Claiming-the-JobMaker-Hiring-Credit/