Employee Terminations

You may be in a situation where your business is severely affected at the moment. Your business income and cash has suffered and you are feeling anxious about whether you can continue to pay your staff now or later. You may reach the conclusion that you have to terminate some of all of your employees in order to keep your business alive. This is not an easy decision and one that takes careful consideration of:

Whether the business is likely to survive the next say 3-6 months with limited or no income

Whether your current and future cash will enable you to continue to pay wages

Whether the business left after 3-6 months will be the same as it is now (i.e. will the business be much smaller?)

Whether you will need your employees to keep the business going now and over the next 3-6 months

Which employees are critical to business operations

The main challenges faced by businesses that may need to terminate some or all of their employees are:

Whether they have enough cash now to pay out the termination packages

Whether they have enough cash at a later date to pay out the termination packages, especially if the employees are not paid for some time due to stand down

Whether wind-up / liquidation may be the only option

Below are the general amounts payable to employees that are being terminated as part of a genuine redundancy:

1. Notice period

The notice period owing is generally based on the length of service and below is the general notice periods based on the period of continuous services:

1 year or less – 1 week

More than 1 year up to 3 years – 2 weeks

More than 3 years and up to 5 years – 3 weeks

More than 5 years – 4 weeks

Over 45 years old – add a week

The amount paid must equal the amount the employee would have been paid if they worked until the end of the notice period which includes:

incentive-based payments and bonuses

loadings

monetary allowances

overtime

penalty rates

any other separately identifiable amounts

The notice period can either be paid out (pay in lieu of notice), the employee can work through their notice period or you can have a combination of both based on your business needs.

If the employee works through their notice period, or part of it, leave entitlements continue to accrue for those hours worked.

If the employee receives the notice period as ‘pay in lieu of notice’, or part thereof, leave entitlements do not accrue for that portion of the notice period payment.

https://www.fairwork.gov.au/ending-employment/notice-and-final-pay

2. Annual leave entitlement

Annual leave is payable (this is the total of the annual leave hours accrued up to the date of termination multiplied by the employee’s hourly rate).

Annual leave loading may also be payable depending on the Award or workplace agreement in place.

3. Long service leave entitlement

If the employee has had a period of continuous service greater than 7 years then the employee is entitled to the long service leave accrued on a pro-rata basis.

Between 7 and 10 years of continuous service, the employee is entitled to 8.667 weeks, pro-rata based on the actual years of service.

For example, if the employee has worked for more than 7 years, they would be entitled to 6.0669 weeks of long service leave (8.667 x 7 / 10).

For every 5 years of continuous employment in the same business after the initial 10 years, an additional 4.333 weeks of long service leave is owing.

4. Redundancy

Work out which employees are entitled to redundancy pay.

The following employees don’t get redundancy pay if they are employed for:

A stated period of time

An identified task or project

A particular season

Employee terminated because of serious misconduct

Casual employees

Trainees engaged only for the length of the training agreement

Apprentices

Some small businesses done have to pay redundancy pay if they employ fewer than 15 employees. There are strict laws around this so its important to seek legal advice to confirm whether this exemption applies.

The amount of redundancy pay the employee gets is based on their continuous service which is the length of time they have been employed by the business and doesn’t include unpaid leave.

The specific redundancy pay entitlement will depend on the specific Award orworkplace agreement but below it the general minimum entitlement:

1 year or less – nil

1 year and less than 2 years – 4 weeks

2 years and less than 3 years – 6 weeks

3 years and less than 4 years – 7 weeks

4 years and less than 5 years – 8 weeks

5 years and less than 6 years – 10 weeks

6 years and less than 7 years – 11 weeks

7 years and less than 8 years – 13 weeks

8 years and less than 9 years – 14 weeks

9 years and less than 10 years – 16 weeks

10 years and over

An employee’s base rate of pay (other than a pieceworker) is the pay rate they receive for working their ordinary hours, but does not include:

incentive-based payments and bonuses

loadings

monetary allowances

overtime and penalty rates

any other separately identifiable amounts

The redundancy component has a tax-free element based on the years of service. For the 30 June 2020 financial year, the base tax-free element is $10,989 plus $5,496 for each complete year of service.

Any redundancy amount over the tax-free limit is part of the employee’s Eligible Termination Payment (ETP) and the way that part is taxed, depends on many factors. Please refer to your accountant for specifics as it is a complicated area of tax.

5. Superannuation

Superannuation will be owing on some of the redundancy package. Below is a brief summary:

Wages paid for hours worked during the notice period – superannuation owing

Pay in lieu of notice – no superannuation

Unused leave entitlements – no superannuation

Redundancy payments – no superannuation

Steps to following for terminating employees:

Check your Award and pay rates and use the online calculators to help you work out the notice and redundancy pay

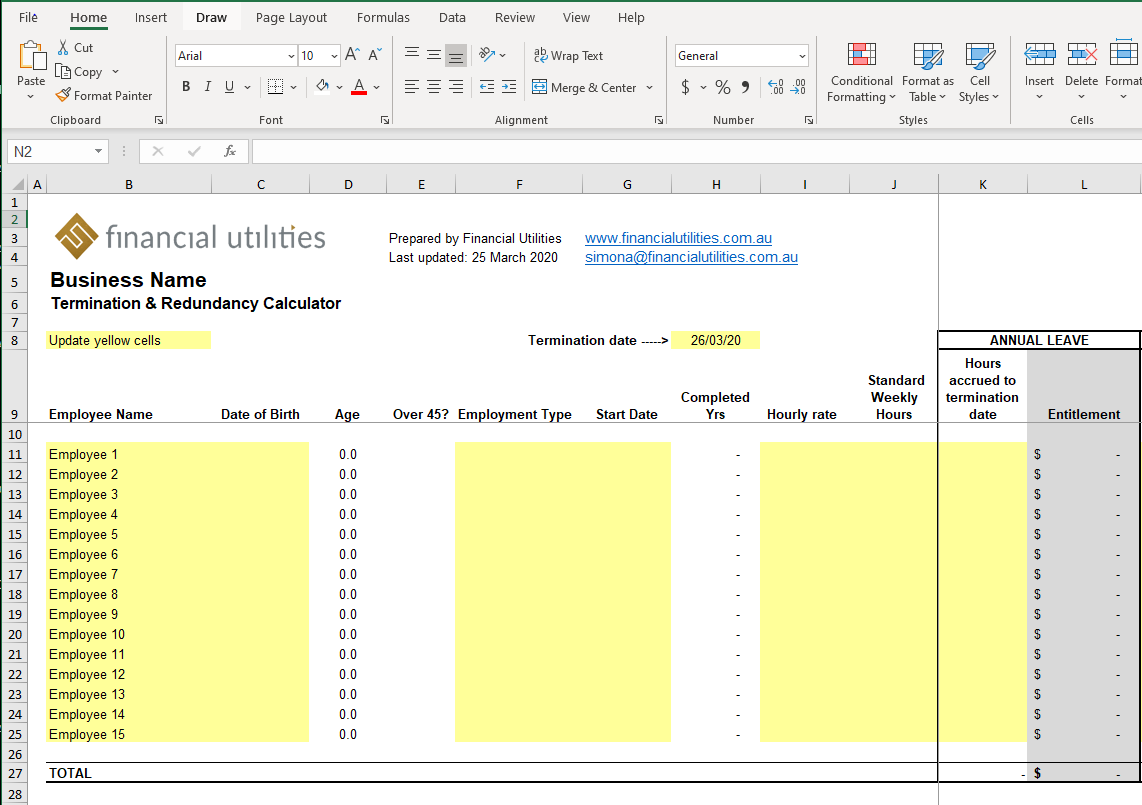

Create a financial summary of the employee entitlements, notice periods and redundancy payments owing per employee. Remember to add superannuation owing where applicable.

Communicate with your employees to explain the next steps and agree whether some of the notice period will be worked by the employee.

Provide written notice of the day of termination.

Calculate the redundancy package including superannuation and tax (including the tax-free redundancy and ETP elements).

RESOURCES

https://www.fairwork.gov.au/ending-employment/notice-and-final-pay

Download our termination and redundancy calculator

https://drive.google.com/file/d/1ptPOzqML5wfvwKx-QlSaXG3RbDBYWCZ-/view?usp=sharing